The latest report by GlobalData Plc titled Buy Now Pay Later (BNPL) Market Size, Share, Trends, Analysis, and Forecast by Region, Channel, Business Model, Spend Category, and Segment, 2021-2026 examines the growing popularity of online payments, particularly, post the pandemic to maintain social distancing as one of the key factors driving the market.

Furthermore, the proliferation of social media and e-commerce coupled with technological advancements in super apps & machine learning are anticipated to boost the market’s growth during the forecast period. However, the BNPL market growth might get hampered due to limitations including regulatory scrutiny, failure to properly disclose terms and conditions, and the presence of strong customer authentication and BNPL credit approval process.

Download the Sample PDF for additional insights on other key market dynamics.

The BNPL market research report provides a wide range of comprehensive and detailed including PORTER’s Five Force Analysis, market variables & impact analysis, COVID-19 impact analysis, M&A activity analysis, patent analysis, job analysis, venture financing analysis, and social media analysis. The report also offers detailed use case studies to highlight how BNPL services are appealing to both consumers and businesses in the way they are ensuring convenient shopping experiences. Extensive value chain insights and components are covered in this study to classify the disruptors and emerging BNPL market participants.

Know more about each analysis covered in the BNPL market research study in this PDF sample

Revenue-generating BNPL Market segments

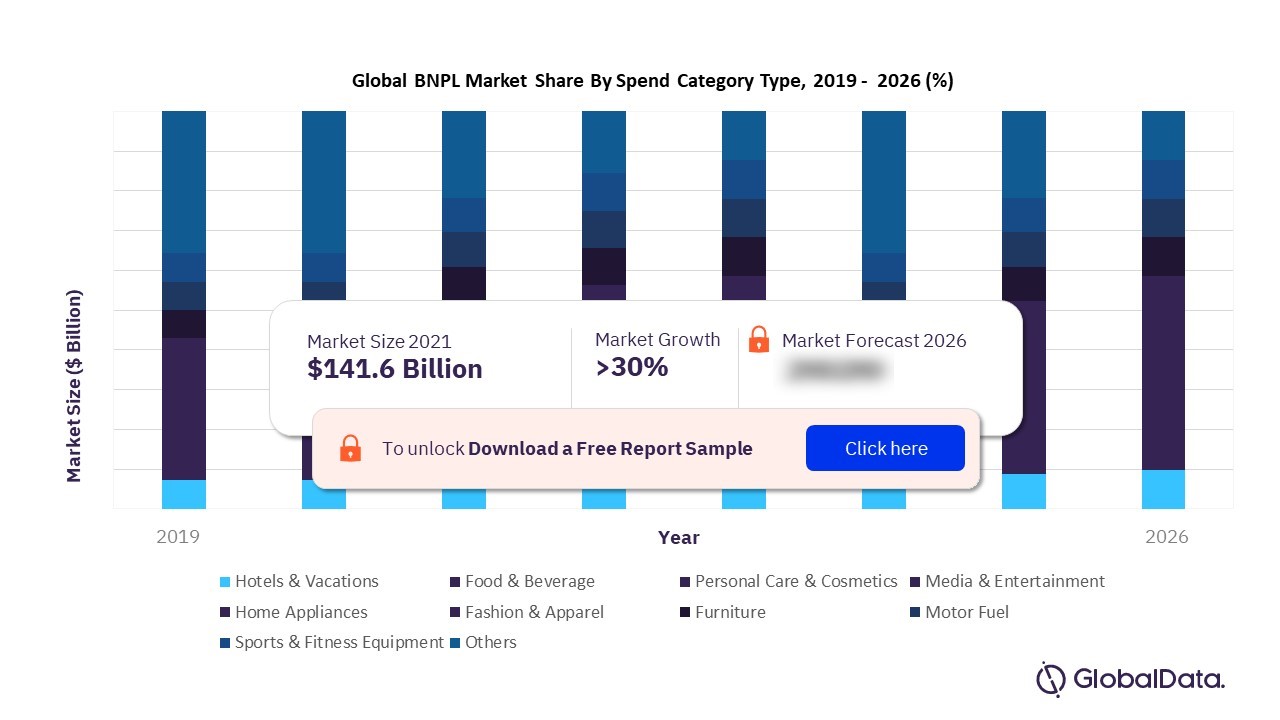

The BNPL market size has been calculated by collecting revenues generated by various segments covered in this report.

- By Channel

- In-store: The in-store channel segment held the largest BNPL market share in 2021. The segment is likely to witness dominance throughout the projected period as many Gen X and Millennials Sentiments still opt for in-store purchases owing to the threat of cyber-fraud. However, with the growing popularity of affiliate marketing

- By Business Model

- Integrated Online Shopping Apps: The Integrated online Shopping Apps (IOSA) segment accounted for the largest market share in 2021 and is expected to dominate over the forecast period. IOSA corresponds to a smaller purchase value typically less than USD 250 allowing consumers notably Generation Z and millennials to avail of BNPL options with installments such as Pay In-4 or Pay Down in Six Weeks options.

- Card Linked Financing

- Off-card Financing

- Virtual Rent to Own Models

- By Spend Category

- Hotels & Vacations: The hotels & vacations spend category earned the largest BNPL market revenue in 2021.

- Furniture

- Home Appliances

- Fashion & Apparel

- Sports & Fitness Equipment

- Media & Entertainment

- Personal Care & Cosmetics

- Food & Beverages/Groceries

- Motor Fuel

- Others

- Regional Opportunities

- Asia Pacific: The BNPL market growth in the Asia Pacific region was contributed by advancing and developed economies including Australia and China. The COVID-19 pandemic has contributed to the growth of BNPL and the decline of credit cards. Consumers concerned by the uncertain economic conditions sought to reduce their debt. BNPL providers like Afterpay enable them to still access credit without having to pay interest. In addition to this, inflation rates across these economies are likely to affect consumers’ spending ability and push them toward BNPL services and other alternatives to credit cards.

- Europe

- Middle East & Africa

- North America

- South & Central America

Grab Sample Report Copy for segment-wise inputs and regional opportunities.

BNPL Market Player Concentration

The BNPL market is gradually intensifying with upcoming vendors launching innovative products and solutions. The BNPL market vendor landscape is also witnessing continuous partnerships and mergers & acquisitions to ensure companies can maintain their dominant positions in the coming period.

Top BNPL Market Companies Covered are:

- Affirm Inc.: Affirm offers a simple, transparent, and hidden charges-free shopping platform. The company also enables customers to repay their monthly bills through cheques, bank transfers, and debit cards. In September 2022, the company partnered with INTERMIX to provide flexible payment options.

- Afterpay Ltd: The company offers technology-driven payment solutions including mobility, health, and e-services. In August 2022, the company partnered with payment provider Square, to integrate the former’s BNPL solution with the latter’s online and in-store payment solution in the UK.

- Amazon Payments, Inc.: Amazon Payments is a secure payments technology company enabling users to make online money transfers. In November 2021, YES BANK collaborated with Amazon Pay and Amazon Web Services (AWS), to offer customers an instant real-time payment system via a UPI transaction facility.

Some more companies and their strategic moves covered in the report are:

- Klarna Bank AB

- Mastercard Inc.

- PayPal Holdings Inc.

- Sezzle Inc.

- Splitit Payment Ltd

- Visa Inc.

- Zip Co Ltd

Request for Sample Report to Retrieve Exclusive Vendor Offerings and Strategic Moves.

Related Reports:

Cloud Computing in Banking – Thematic Research

Hong Kong – Retail Banking Consumer Profiles

Germany Retail Banking Consumer Profiles and Analysis

About GlobalData

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. As a leading information services company, thousands of clients rely on GlobalData for trusted, timely, and actionable intelligence. Our mission is to help our clientele ranging from professionals within corporations, financial institutions, professional services, and government agencies to decode the future and profit from faster, more informed decisions. Continuously enriching 50+ terabytes of unique data and leveraging the collective expertise of over 2,000 in-house industry analysts, data scientists, and journalists, as well as a global community of industry professionals, we aim to provide decision-makers with timely, actionable insights.

Media Contacts:

Mark Jephcott

Head of PR EMEA

[email protected]

cc: [email protected]

+44 (0)207 936 6400

Add Comment